Managerial accounting is a branch of accounting that produces financial and nonfinancial information for internal use by business managers. This type of accounting focuses on the sourcing, analysis, and reporting of these various kinds of data. In many cases, it is also used for decision-making within the business. For example, managerial accountants can monitor the cost-cutting process, as well as the production output, to improve the company’s operations.

During the planning process, managers must assess the profitability of their company. They use managerial accounting information to develop budgets, set financial goals, and make plans. It also serves as an important tool for overall performance analysis. For example, managerial accountants can determine patterns in historical data and investigate fluctuations in data to derive actionable insights and make predictions about future trends. Trend analysis, also known as horizontal analysis, focuses on mapping patterns in cost and revenue information. For help from Bath Accountants, visit chippendaleandclark.com/accountant-in-bath

Nonmanufacturing costs include costs that are not yet put into production. Examples include the legal staff working on production personnel, but also human resources staff that hire assembly line workers. These costs are classified in different ways in managerial accounting. The goal is to present the information in a way that satisfies the needs of the users. It’s a better alternative to traditional financial accounting. But what are the differences between managerial accounting and financial accounting?

Financial and nonfinancial information produced by managers is more detailed than that found in financial reports. For example, the financial information provided in an annual report may give only a general picture of the company’s financial performance, but not specific information on product profitability. In contrast, managerial accounting provides detailed financial and nonfinancial information to internal users, allowing them to better plan, evaluate costs, and make decisions. This type of accounting is also used to monitor the effectiveness of management.

When you think about it, managers constantly plan for the future. They set goals, communicate them to employees, and measure whether they achieved them. This is where control functions come in. In personal budgeting, you set income and expense goals and managerial accounting follows the same principles but goes into greater depth and detail.

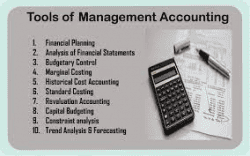

As the title suggests, managerial accounting helps organisations manage costs effectively. The information gathered through managerial accounting helps businesses to determine prices and quantities, and determine whether to hire extra staff. Managing expenses is vital, but it is also important for determining benefits and returns on activities. Managerial accounting also helps in evaluating the financial statements of an organisation. This is a vital process for any business, regardless of size. It helps to make better decisions and plan the business’s future.